The Mercosur Stablecoin: De-Risking the Dollar-Dominated Portfolio

A Hedge Against Uncertainty

The global financial landscape is increasingly defined by monetary expansion and escalating national debt in developed economies, particularly the US. This environment poses a long-term risk to the purchasing power of the US Dollar, the world's reserve currency.

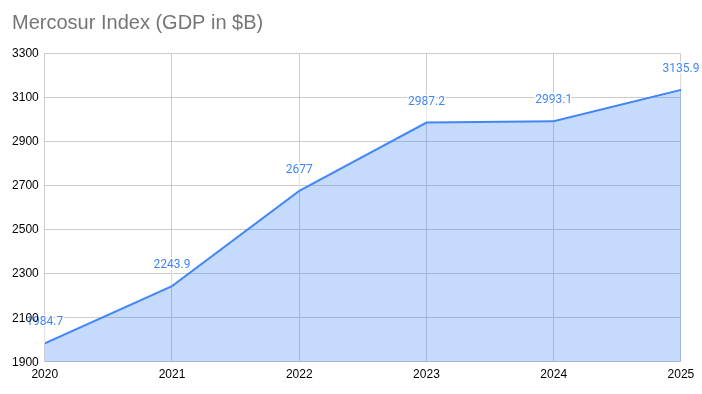

The Mercosur Index USD Stablecoin (miUSD) is a proprietary, growth-pegged digital asset designed to de-risk portfolios by pivoting away from the dollar system's inherent fiscal challenges. Pegged to a basket of economic and trade indicators of the Mercosur bloc nations ( Brazil, Argentina, Uruguay, Bolivia, and Paraguay), the miUSD aims to capture the rapid, fundamental growth of this emerging market region, offering an attractive average historical growth rate of 9.78%.

For stability and liquidity provision, we offer a 10% Annual Percentage Yield (APY) for staking the miUSD stablecoin.

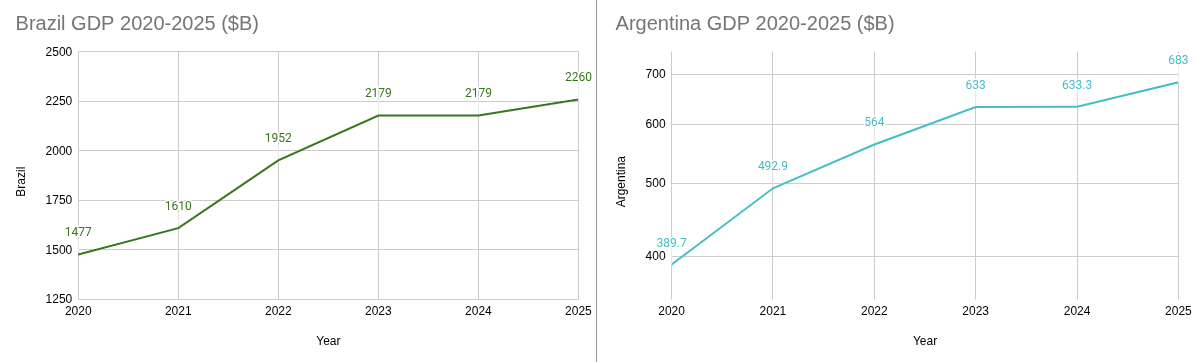

GDP by Country:

Year: 2020

- Brazil: 1477

- Argentina: 389.7

- Uruguay: 54

- Bolivia: 34

- Paraguay: 30

Year: 2021

- Brazil: 1610

- Argentina: 492.9

- Uruguay: 66

- Bolivia: 40

- Paraguay: 35

Year: 2022

- Brazil: 1952

- Argentina: 564

- Uruguay: 75

- Bolivia: 44

- Paraguay: 42

Year: 2023

- Brazil: 2179

- Argentina: 633

- Uruguay: 81

- Bolivia: 49.7

- Paraguay: 44.5

Year: 2024

- Brazil: 2179

- Argentina: 633.3

- Uruguay: 85

- Bolivia: 48.4

- Paraguay: 47.4

Year: 2025

- Brazil: 2260

- Argentina: 683

- Uruguay: 86.5

- Bolivia: 56.3

- Paraguay: 50.1

| Year | Brazil | Argentina | Uruguay | Bolivia | Paraguay |

|---|---|---|---|---|---|

| 2020 | 1477 | 389.7 | 54 | 34 | 30 |

| 2021 | 1610 | 492.9 | 66 | 40 | 35 |

| 2022 | 1952 | 564 | 75 | 44 | 42 |

| 2023 | 2179 | 633 | 81 | 49.7 | 44.5 |

| 2024 | 2179 | 633.3 | 85 | 48.4 | 47.4 |

| 2025 | 2260 | 683 | 86.5 | 56.3 | 50.1 |

The Dollar Debt Trap: Why Diversification is Essential

The US Dollar's role as the world's primary reserve currency has allowed the US to finance massive national debt through quantitative easing (money printing). While this provides short-term fiscal flexibility, it carries significant long-term risks for both US and global investors:

- Erosion of Purchasing Power (Inflation Risk): Excessive money supply growth can lead to inflation, effectively devaluing all dollar-denominated assets, including cash and bonds. The dollar's value is constantly diluted as more of it is printed.

"If the government prints too much money, people who sell things for money raise the prices for their goods, services and labor. This lowers the purchasing power and value of the money being printed."

- National Debt Crisis: The US national debt-to-GDP ratio is at levels not seen since World War II. Someone must ultimately pay the debt, whether through spending cuts, tax increases, or, most damagingly for the dollar, devaluation via inflation.

- Geopolitical Risk: The use of the dollar in global financial sanctions has prompted many countries to seek alternatives, leading to a slow, ongoing process of de-dollarization. This fragmentation can reduce the dollar's dominance and stability over time.

The Mercosur Advantage: A Fundamental Growth Engine

The Mercosur economic bloc, comprising Brazil, Argentina, Uruguay, Bolivia, and Paraguay, represents a powerful engine of emerging market growth. They are characterized by:

- Rapid GDP Expansion: Emerging markets typically exhibit faster GDP growth rates than saturated developed economies (Source: IMF data). The average year-over-year growth for the index's underlying metrics has been approximately 9.78% (based on a previous analysis of select economic indicators), significantly outpacing many developed market benchmarks.

- Commodity Powerhouse: The region is a global leader in agriculture, minerals, and energy, providing real-world asset backing and a hedge against global supply chain volatility.

- Trade Alignment: Mercosur's trade agreements and the use of the Local Currency Payment System (SML) for intra-bloc transactions reduces their reliance on the US Dollar, insulating their trade from the volatility and high transaction costs of the dollar system.

The miUSD Stablecoin: Structure and Value Proposition

The miUSD blends digital stability with emerging market growth.

| Feature | Description |

|---|---|

| Peg Mechanism | The miUSD price is soft-pegged to the value of a basket of Mercosur economic indicators (e.g., combined trade volumes, GDP growth rates, and sovereign bond yields). |

| Growth Potential | Designed to capture the 9.78% average growth rate of the underlying Mercosur economic index. |

| Defensive Position | Offers a non-dollar-centric store of value, acting as an inflation and devaluation hedge for dollar-based investors. |

| Yield Generation | Stake your miUSD to earn a competitive 10% APY. This provides liquidity providers with an attractive return while simultaneously ensuring the stability and depth of the coin's liquidity pools. |

Why This is "Cool" for Dollar-System Citizens

For individuals and institutions in the US or other dollar-pegged economies, the miUSD stablecoin offers a crucial benefit: uncorrelated growth.

- Inflation Hedge: You can shift savings from dollar-denominated assets, which are losing purchasing power, into an asset pegged to a growing, productive emerging market bloc.

- Access to Emerging Markets: Investing in foreign markets traditionally involves complex brokerage, taxes, and currency conversion fees. The miUSD stablecoin simplifies this by providing instant, tokenized exposure through a single asset on a global blockchain.

- Passive Income: The 10% Staking APY is significantly higher than most savings accounts, money market funds, or traditional fixed-income products in developed markets, providing a powerful incentive to hold the growth-pegged asset.

Decentralization, Sanctions, and Global Capital Access

The miUSD stablecoin’s decentralized nature and its peg outside of the US Dollar system provide critical advantages in an increasingly fragmented global financial environment dominated by the use of sanctions as a geopolitical weapon. The dollar system's reliance on centralized intermediaries (like the SWIFT banking network) means that nations, entities, or even entire regions can be easily cut off from global commerce and capital flows by major reserve currency countries.

The miUSD, built on a public blockchain, fundamentally bypasses these centralized control points. By providing a decentralized, stable, and growth-oriented unit of account, the miUSD offers Mercosur countries a powerful tool:

- Sanctions Resilience: While not an explicit tool for sanctions evasion, a truly decentralized network offers a financial rail that is permiUSDsionless and censorship-resistant. This makes it difficult for any single government to unilaterally freeze or block transactions, offering a vital degree of resilience for regional trade and capital formation against external geopolitical pressures.

- Direct Access to Global Capital: Crucially, the miUSD stablecoin provides direct, tokenized access to global capital markets. Investors worldwide (including those seeking a dollar hedge) can buy, hold, and stake miUSD with minimal friction, avoiding the lengthy, costly, and often restrictive intermediary layers of traditional cross-border finance. This allows Mercosur's growing industries (AI, Clean Energy) to secure international investment through an open-source, neutral platform, dramatically lowering the cost of capital and accelerating their integration into the worldwide economy.

Mercosur: Land of Opportunity and Rich Culture

Beyond the economic fundamentals, the Mercosur region offers immense cultural and natural wealth that drives foreign investment, tourism, and long-term stability.

- Brazil 🇧🇷: Home to the Amazon Rainforest and the iconic cuisine of Churrasco (Brazilian BBQ). Its vast resources are key to global sustainability.

- Argentina 🇦🇷: Famous for the dramatic Andes Mountains, the passion of Tango, and world-renowned beef and Malbec wine.

- Uruguay 🇺🇾: Known for its stable democracy, beautiful coastline, and high quality of life. The food scene includes Chivito sandwiches.

- Bolivia 🇧🇴: Features the surreal Salar de Uyuni (salt flats) and a rich indigenous heritage.

- Paraguay 🇵🇾: The "Heart of South America," offering the stunning Iguazu Falls (shared with Brazil and Argentina) and unique Sopa Paraguaya (a dense cornbread).

This blend of natural resources, a growing middle class, and cultural depth provides the stability and demand required for sustained long-term economic growth, making the Mercosur Index USD Stablecoin a truly de-risked and rewarding investment.

This is an excellent application of stablecoin design, moving beyond mere price stability to create a programmable economic engine for regional development.

Here is the proposed tokenomics for the Mercosur Index USD Stablecoin (miUSD), focused on attracting talent and investing in high-growth, sustainable industries like AI and Clean Energy.

Tokenomics: miUSD – The Engine of Mercosur

The Mercosur Index USD Stablecoin (miUSD) is not just an asset; it is a capital formation and allocation vehicle structured as a Decentralized Autonomous Organization (DAO). Its design ensures that the 9.78% average growth of the underlying economic index is systematically reinvested into the future productivity of the Mercosur bloc.

1. miUSD Token Allocation & Treasury Strategy

The total supply of miUSD is dynamic (algorithmic/collateralized) to maintain its soft-peg to the Mercosur Index value. The key component is the management of the Seigniorage (the difference between the value of the miUSD and the cost to mint it) and the Staking Rewards to fund strategic initiatives.

| Allocation Pool | Source of Funding | Purpose |

|---|---|---|

| Growth Treasury | 50% of all Seigniorage +20% of all Protocol Fees | Funding key Mercosur-focused growth sectors (AI, Clean Energy, Digital Infrastructure). |

| Talent & Ecosystem Fund | 30% of all Seigniorage + 5% of all Protocol Fees | Talent grants, developer bounties, and educational programs to attract AI/IT/Energy specialists. |

| Stability Reserve | 20% of all Seigniorage + 75% of all Protocol Fees | Ensuring collateral reserves, maintaining the soft-peg, and funding the 10% APY Staking Pool. |

The Value-Capture Loop

- Minting/Usage: New miUSD is minted as demand grows, creating Seigniorage.

- Growth: The Mercosur Index grows at an average rate of 9.78%.

- Reinvestment: The Seigniorage and Protocol Fees are allocated to the three pools, guaranteeing capital flows into the Growth and Talent funds.

- Adoption/Demand: The success of AI/Clean Energy projects (e.g., green data centers in Brazil, lithium mining in Argentina) increases the underlying economic activity, boosting the Mercosur Index, which in turn increases demand for miUSD and repeats the loop.

2. Incentivizing Talent: The "miUSD Talent Bounty"

To directly address the need for skilled labor in emerging technologies, the miUSD tokenomics includes specific incentives for attracting talent both within the bloc and globally.

A. 10% Staking APY (The Anchor)

- Mechanism: Token holders lock their miUSD for fixed periods (3, 12, 36 months).

- Source: Funded primarily by the Stability Reserve (75% of Protocol Fees) and the predictable 9.78% index growth.

- Goal: Provides a highly competitive, de-risked yield for non-dollar assets, attracting citizens from the US/Europe seeking a hedge and passive income. This ensures deep liquidity and price stability.

B. Developer Grants (Talent Acquisition)

The Talent & Ecosystem Fund allocates miUSD tokens for:

| Grant Type | Focus Area | Impact |

|---|---|---|

| AI Innovation Grants | Projects focused on AI applications for Mercosur agriculture (e.g., precision farming in Brazil) and resource optimization. | Attracts top AI developers to solve high-value, local problems. |

| Green Code Bounties | Bounties for developers creating open-source tools for renewable energy grid management, tokenized carbon credits, and decentralized environmental monitoring. | Builds a regional, tech-enabled environmental compliance framework. |

| Education Vouchers | Vouchers denominated in miUSD, redeemable for accredited AI/Clean Energy university courses and certifications within the Mercosur countries. | Directly invests in upskilling the local and regional workforce. |

3. Targeted Investment: Funding the Future of Mercosur

The Growth Treasury acts as a decentralized sovereign wealth fund, allocating capital toward strategically vital, high-growth sectors, accelerating the index's growth rate beyond traditional methods.

A. AI Infrastructure & Research

The Treasury will finance projects that build the computational backbone necessary for AI development across the region.

- Example 1: Sustainable Data Centers: Investment in the construction of green data centers (like the projects currently being developed in Brazil) that utilize the region's abundant hydropower (Uruguay, Paraguay) or solar/wind resources (Argentina) for AI compute.

- Example 2: AI Research Hubs: Seed funding for decentralized autonomous organizations (DAOs) dedicated to public-good AI research across member state universities.

B. Clean Energy & Critical Minerals

Mercosur's greatest global competitive advantage is its massive endowment of clean energy potential and critical minerals for the energy transition.

- Example 1: Lithium Tokenization: Investment into sustainable extraction and processing of lithium in Argentina and Bolivia, linking miUSD directly to the supply chain of the global EV/battery market.

- Example 2: Green Hydrogen Projects: Financing the build-out of infrastructure for Green Hydrogen production in coastal areas like Uruguay, further enhancing the region's energy independence and export revenue.

Conclusion: The miUSD Stablecoin is a De-Risked Growth Strategy

miUSD stands as the foundational pillar for decentralized finance within the Mercosur region. We have presented a robust, inflation-resistant stablecoin mechanism (miUSD) designed not just for stability, but for promoting regional economic integration and efficient cross-border settlement. By anchoring value to a composite index, we mitigate single-currency risk and offer a transparent, reliable unit of account.

The tokenomics of the miUSD create a virtuous cycle:

- Safety: Investors de-risk their dollar exposure by holding a stablecoin backed by a fundamentally growing economic bloc.

- Reward: They are rewarded with a 10% for staking, providing powerful yield.

- Impact: Their staked capital is used to fund the very technologies (AI, Clean Energy) that drive the underlying index growth, creating a self-reinforcing model of regional prosperity and global competitiveness.

- Tokenomics & Governance: The structure is designed for community-led evolution, ensuring the protocol remains adaptive to the dynamic needs of the Mercosur economy.

miUSD transforms dollar flight into productive, sustainable emerging market investment.

We invite developers, investors, and regional partners to join us in building this crucial infrastructure.